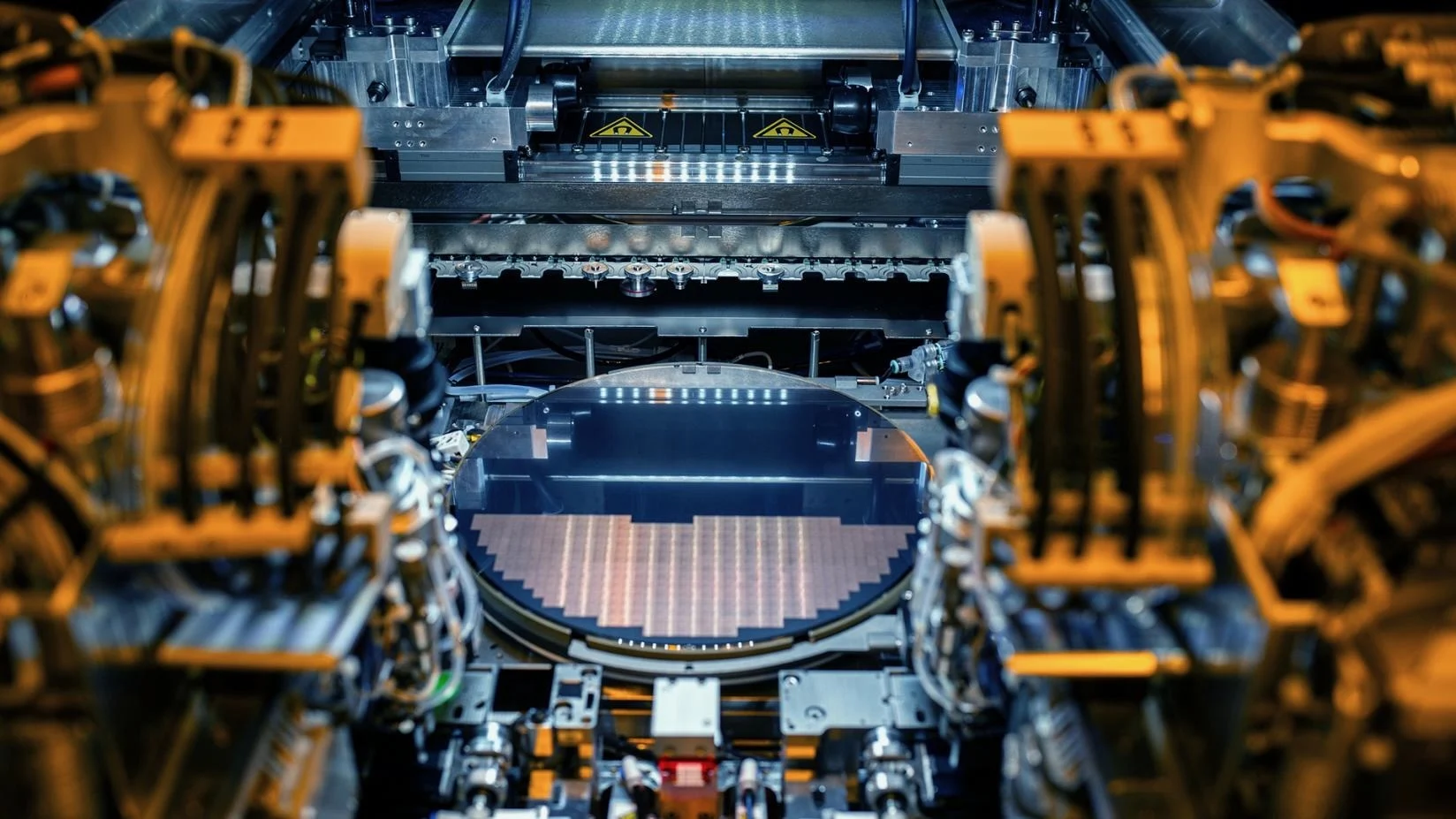

Intel could be changing course in a big way. According to people close to the matter, new CEO Lip-Bu Tan is considering pulling back on promoting Intel’s 18A chip process to outside companies and instead focusing efforts on its upcoming 14A technology.

Why the shift? Because the 18A process, heavily backed by former CEO Pat Gelsinger, hasn’t attracted many new external clients. And Intel sees more opportunity—and better results—with 14A.

Intel’s New Strategy: Focus on What Works

If this new plan goes through, Intel would stop trying to sell 18A to new foundry customers. Instead, the company would put its energy into developing and improving 14A, which it believes can compete more directly with TSMC, the global leader in chip manufacturing.

Intel still plans to use 18A for its own products, including the upcoming Panther Lake processors set to launch in late 2025.

Also, it will continue to honor existing 18A contracts with big partners like Amazon and Microsoft—so current commitments won’t be affected.

Big Decision, Big Price Tag

Shifting away from 18A might make sense strategically, but it won’t come cheap.

Intel may need to take a one-time financial hit of several hundred million dollars—or possibly more than $1 billion—to account for previous 18A investments and canceled efforts.

The company’s board is expected to discuss and vote on this move later this fall, and no final decision has been made yet.

Intel declined to comment on the speculation, simply stating that it remains the main user of 18A and plans to move forward with Panther Lake production as scheduled.

What Makes 14A So Important?

Intel believes its 14A process could be a better fit for the competitive chip market. It’s seen as:

- More efficient to develop

- More aligned with customer needs

- More likely to win over high-value clients like Apple and Nvidia

If Intel can deliver solid performance with 14A, it might regain some ground in the global chip race.

How’s Intel Stock Looking?

Intel’s stock performance has been under close watch. Here’s a quick snapshot:

- Current share price: $22.85

- Average analyst target: $21.20

- High estimate: $28.30

- Low estimate: $14.00

- GuruFocus fair value: $23.86 (suggesting a modest 4.42% upside)

With mixed forecasts, investors are keeping a close eye on how this chip strategy shift plays out.

TL;DR — What You Need to Know

- Intel is thinking about stopping 18A marketing to new clients.

- It would focus on 14A technology, aiming to bring in Apple and Nvidia.

- Existing 18A projects with Amazon and Microsoft will continue.

- A change like this could cost Intel up to $1 billion in write-offs.

- The board will make a decision later this year.

- Panther Lake, built on 18A, is still on track for 2025.

- Intel hopes this pivot will help it better compete with TSMC.

Final Word

Intel is at a crossroads. With new leadership and changing priorities, the company is making tough decisions to stay relevant in a fast-moving tech world.

If the shift to 14A pays off, Intel could be back in the race to win over top-tier clients and push past industry rivals.