Let’s talk real for a moment — if you’re building a Web3 startup, your token economy isn’t just important. It’s everything.

Tokens are more than digital coins. Done right, they can power your platform, grow your community, and keep everything running smoothly without needing a middleman.

But here’s the thing — lots of projects mess this part up.

So in this guide, I’m breaking down how to build Token Economy for Your Web3 Startup— using plain language, clear steps, and examples that actually make sense.

What Even Is a Token Economy?

Think of a token economy like the financial engine behind your Web3 project. It’s the system that decides:

- How your token is used

- Why someone would want to hold or spend it

- How you grow, reward, and keep users around

If you’re building a blockchain game, for example — the token might let users buy gear, vote on new features, or earn rewards.

If your token has no real use? It turns into just another speculative coin people dump at the first pump.

Why Getting This Right Actually Matters

You’ve probably seen this before: new Web3 project launches with tons of hype… then crashes in a month. Why? Their tokenomics were broken.

A sustainable token economy does three key things:

- Keeps your token valuable

- Grows your community

- Aligns everyone’s interests (users, devs, investors)

Here’s How You Build Token Economy for Your Web3 Startup— Step by Step

1. Start with the Token’s Purpose

Before you even touch code or whitepapers, ask yourself:

- What role will this token play?

- What will people do with it?

- How will it help my platform grow?

Real Example:

On platforms like Uniswap, the token lets people vote on key decisions. It’s useful — not just something to trade.

If your users aren’t using the token regularly, its value won’t hold for long.

2. Decide on the Token Type

Most tokens fall into three categories:

- Utility tokens – let people use features or services (like buying, staking, etc.)

- Governance tokens – give voting rights on platform decisions

- Security tokens – are more like shares/investments (and may need to follow laws)

You can mix types, but make sure the lines are clear. And make sure the community knows what they’re holding.

3. Balance the Supply & Demand

Now, let’s talk token supply. Too much? Token price drops. Too little? No one can access your ecosystem.

Here’s what smart projects do:

- Set a max supply (don’t just print tokens forever)

- Use vesting so founders and early investors can’t dump on users

- Add staking or burning to reduce supply and boost value

Quick Chart:

| Feature | Why It Helps |

| Vesting | Prevents dumps after launch |

| Staking | Rewards loyal holders |

| Burning | Creates scarcity, boosts value |

4. Fair Token Distribution

This one’s huge.

If 90% of your token supply is owned by the team or private investors, people won’t trust the project.

Instead:

- Reserve tokens for users and the community

- Set aside a pool for contributors and developers

- Be super transparent about who gets what, and when

Example:

Many projects now do airdrops to reward early supporters — not influencers or insiders.

5. Align Incentives with Your Users

This means your users should benefit when your project grows. That way, they’re motivated to help you win.

You can:

- Reward users for referrals or activity

- Offer bonuses for long-term staking

- Let token holders vote on key decisions

If your token is just a number on a screen, people will trade it and move on. Give it a reason to exist.

6. Introduce Community Governance (When You’re Ready)

Governance sounds technical, but it’s really just giving your users a voice.

As your project grows, let the community vote on stuff like:

- Platform upgrades

- Treasury spending

- Rule changes

Tools like Snapshot make it easy. This helps users feel involved — and that creates loyalty.

Mistakes to Avoid (Because They’ll Kill Your Project Fast)

| Mistake | Why It’s Bad | What to Do Instead |

| Releasing all tokens at once | Causes price crashes | Use time-based release/vesting |

| No actual use for the token | It’ll lose value fast | Make tokens necessary to use features |

| Centralized control | Users won’t trust you | Add governance as you grow |

| Poor communication | Confuses users | Be clear and honest always |

Real Projects Doing It Right

Here are a few examples of token economies that actually work:

1. Chainlink (LINK)

Users need LINK to pay for using Chainlink’s data oracles. This creates real demand for the token.

2. Helium (HNT)

People earn HNT by running wireless hotspots. It ties the token to a real-world action.

3. Arbitrum (ARB)

Holders vote on network changes. Governance in action.

These projects all designed with purpose first, not hype.

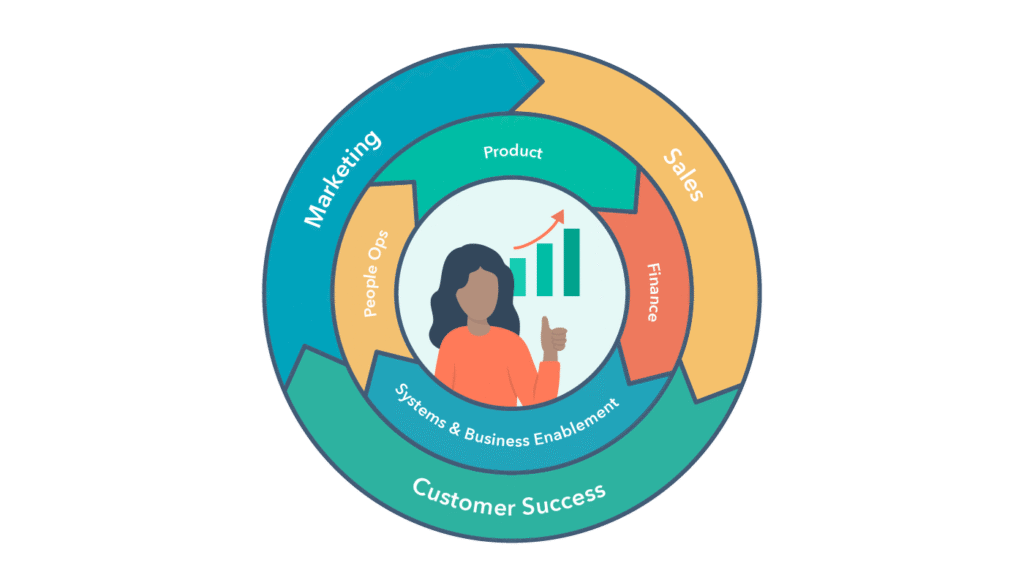

A Visual Breakdown of the Token Journey

You can visualize this as a cycle, not a straight line. It keeps evolving.

Why This All Matters for Your Web3 Startup

If you’re building a product — whether it’s in DeFi, gaming, or social — your token economy isn’t a side project. It’s the backbone.

Tokens can:

- Fund your development

- Attract early adopters

- Reward contributors

- Guide community growth

But none of that happens if your tokenomics are built on hype, not logic.

Wrapping Up: Keep It Real, Keep It Useful

Designing a token economy for your Web3 startup doesn’t need to be overly complex or full of buzzwords.

Just focus on the basics:

- What problem are you solving?

- Why should someone want your token?

- How does your project grow when users get involved?

That’s what makes a token economy sustainable.

Frequently Asked Questions (FAQ)

About Token Economies for Web3 Startups

1. What is a token economy in Web3?

A token economy is a system where digital tokens are used to power a Web3 platform. Tokens can be used for access, rewards, governance, or payment within a decentralized application. It’s like a digital economy where tokens are the main currency.

2. Why do Web3 startups need a token economy?

A token economy helps Web3 startups:

- Grow their community

- Incentivize users

- Raise funds

- Enable governance

It creates a self-sustaining ecosystem where users are rewarded for their participation and loyalty.

3. How do I create a sustainable token economy?

To build a healthy token economy, you should:

- Define the token’s purpose

- Control its supply (not too much or too little)

- Distribute it fairly

- Align user incentives with platform goals

- Introduce decentralized governance

This ensures long-term growth and user trust.

4. What’s the difference between utility, governance, and security tokens?

- Utility Tokens: Give access to features or services (e.g., buy, stake, mint).

- Governance Tokens: Let holders vote on changes to the platform.

- Security Tokens: Act like investments or shares (regulated in many countries).

5. What are some common token distribution models?

Most startups split token supply into:

- Team and founders

- Early investors

- Community rewards

- Treasury or reserves

- Public or airdrop participants

A vesting schedule is usually applied to prevent early dumping.

6. What happens if the token has no utility?

If a token has no use, users won’t hold it. It becomes speculative and can lose value fast. Utility gives the token real demand inside your platform.

7. How do I prevent my token from crashing after launch?

Avoid price crashes by:

- Using vesting for investors

- Launching in phases (private, then public)

- Offering staking rewards

- Creating real use cases before launch

8. What is staking and why is it useful?

Staking means locking up tokens to earn rewards. It helps:

- Reduce token supply (less in circulation)

- Reward long-term holders

- Boost token value and ecosystem trust

9. When should I introduce governance in my project?

You don’t need governance right away. Add it once your platform has:

- A solid user base

- Multiple features

- A community that cares about decisions

Start small, using tools like Snapshot.

10. Are token economies legal everywhere?

It depends on your location. Some tokens (like security tokens) may require legal compliance. Always consult a crypto-savvy lawyer when launching or selling tokens.